- Strategy launches euro-based perpetual share offering (STRE) for European qualified investors.

- Proceeds from the offering are to be used solely for further Bitcoin accumulation and operations.

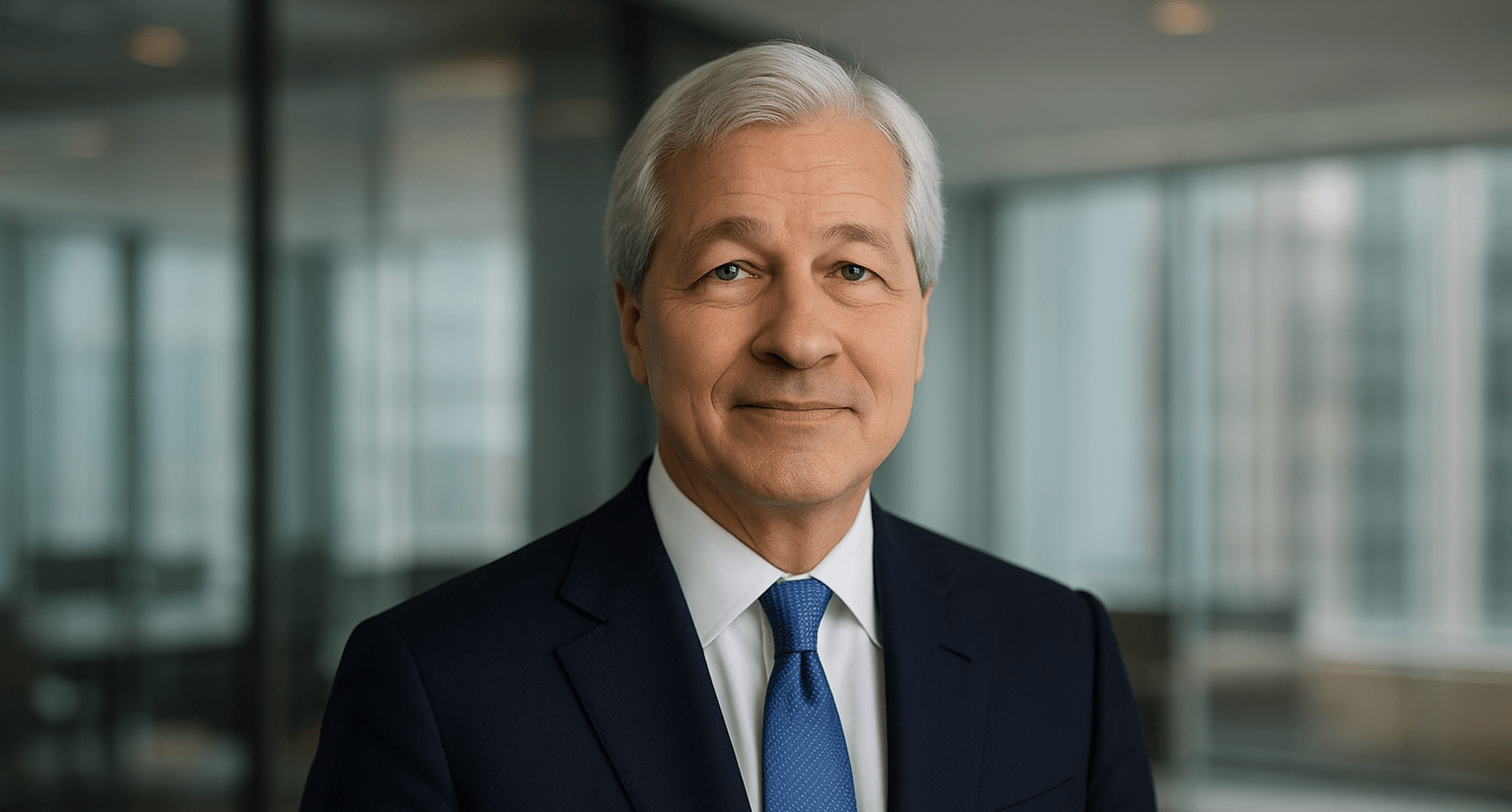

The Strategy by Michael Saylor has revealed intentions to launch a euro-based stock offering as another bold move in its Bitcoin accumulation campaign. The crypto treasury company submitted a preliminary public offering of 3.5 million perpetual shares under the STRE ticker to European investors on Monday.

Expanding Bitcoin Treasury Through European Markets

The strategy plans to release proceeds of the euro stock sale solely to the acquisition of additional Bitcoin and to facilitate overall operational needs. The perpetual shares are subject to a cumulative dividend of 10% per annum on a stated value of 100 euros, which will be paid quarterly, commencing on December 31.

The offering is, however, limited to qualified investors in the European Union and the United Kingdom, but not retail investors in these jurisdictions. Strategy is the biggest Bitcoin holder among publicly traded companies, with 641,205 BTC bought at a total cost of about $47.49 billion.

In early November, the company bought another 397 Bitcoin, as it has maintained an intensive accumulation policy since mid-2020. The new business model presented by Saylor is the issuance of equity and debt securities to raise capital that would be used to increase the Bitcoin holdings of the company.

The strategy has given rise to many copycats who have opened up comparable crypto treasury businesses, raising billions of dollars to hoard Bitcoin and other cryptocurrencies. On Thursday, the founder stressed that Strategy is still devoted to its original business model of selling digital credit and purchasing Bitcoin in a systematic manner.

Although there may be opportunities, Saylor affirmed that the company has no plans to make mergers or acquisitions even when such transactions may seem profitable.

Certain market analysts are worried about the sustainability since the competition is growing, and consolidation might be needed to ensure that crypto treasury companies survive. Major financial institutions such as Barclays, Morgan Stanley, Moelis and TD Securities are acting as book-running managers of this European offering.

The shares of the STRE are further attempts by Strategy to expand its sources of capital raising beyond the conventional dollar-denominated securities in the American markets. As of today, when Bitcoin is trading at over $104,000, the current holdings of Strategy have translated to massive unrealized profit relative to the average cost of acquisition.

The innovative nature of the company is still redefining the manner in which companies can incorporate cryptocurrency into their treasury management and capital allocation policies successfully.